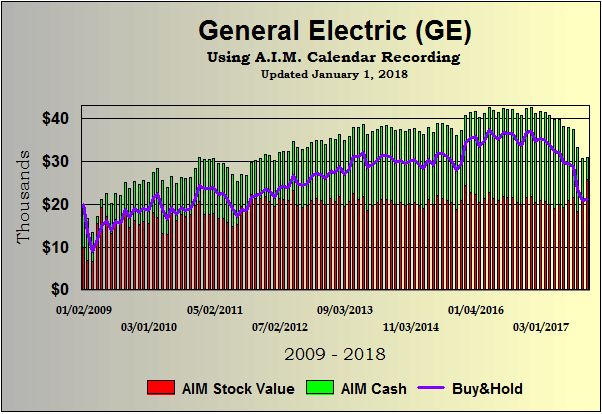

The below portfolio outlines my adaptation of Robert Lichello’s A.I.M. (Automatic Investment Management) using General Electric (GE). I have chosen GE because it is one of the most widely held stocks, and one many people are familiar with. His basic system was outlined in his book “How To Make $1,000,000 in the Stock Market Automatically!”, published in 1977, which I first read in the late 1980’s. I have adjusted the SAFE value from a straight 10% for buys and sells as outlined in the book, to 8% for a SELL and 0% for a buy as recommended on several of the AIM user web sites. Individual stocks are not the best vehicles to use in this system. They do not provide diversity, run the risk of going to “zero” dollars, and often times do not move enough in price to trigger a sufficient number of buys and sells to take advantage of the math in Lichello’s system. Using better vehicles, consistent double digit annual returns are common. In addition to the AIM portfolio net, broken down into cash (green bars) and stock (red bars), I have included a purple line that tracks the return of the 100% invested buy-and-hold investor.

| A Few Notes About Robert Lichello’s A.I.M. and my Adaptation: |

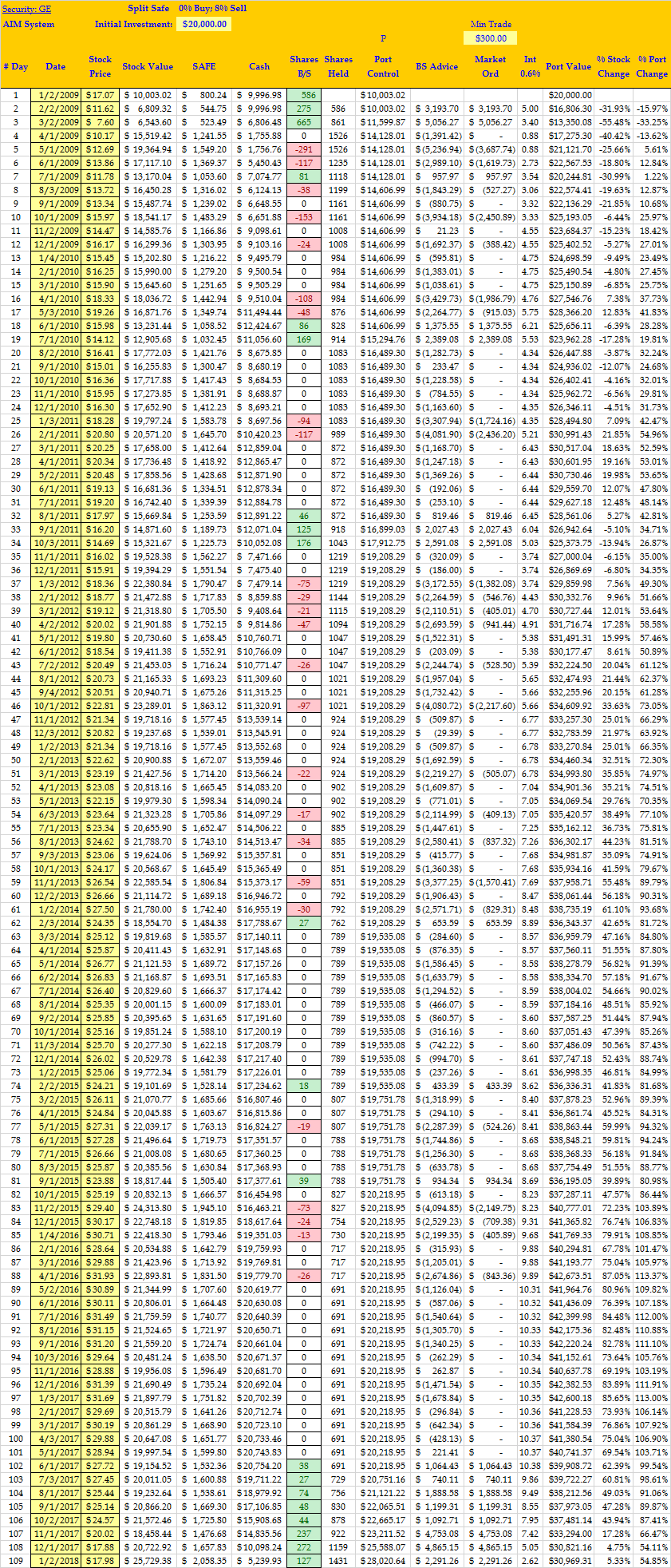

| The investment system is easy to use, requires little time or investment knowledge, and provides superior returns over the long term. It is ideal for a self directed IRA. How It Works:I have set up the above sample portfolio in a spread sheet to be updated once a month on the first trading day of the month. Spread Sheet Set Up: Column # 1 – The month number the system has been utilized 2 – The date of the first trading day of each month 3 – The closing stock price in dollars the first trading day of each month 4 – Stock value (Column 3 X Column 8) 5 – SAFE = 0.08 X Column 4 6 – Cash = starting cash – (Column 6 + Column 11) + Column 12 7 – Shares Bought/ Sold (Column 11 / Column 3) rounded to the nearest whole share, minus for sales, plus for buys 8 – Shares Held (Previous/Above Column 8 value + or – Column 7) 9 – Portfolio Control (Amount of initial investment then add 1/2 the amount of any subsequent purchases. No adjustment made for sales. 10 – Buy/Sell Advice (Column 9 – Column 4) If result is negative, it is a sell. If result is positive, it is a buy. 11 – Market Order (Buy Orders = Column 11, Sell Orders = Column 11 – Column 4) 12 – Record the monthly interest you receive for your cash 13 – Portfolio Value (Column 4 + Column 6) |