Among people that have attended my 5 Minutes a Month to Superior Investment Returns workshops, TNA, SSO and XIV are the most common investment vehicles.

I said last week, we could get a buy signal this week. The down action of recent days has delayed that signal, but we can get a hint as to what may lead the market off the bottom. We must be patient and wait for the signal the market is always right.

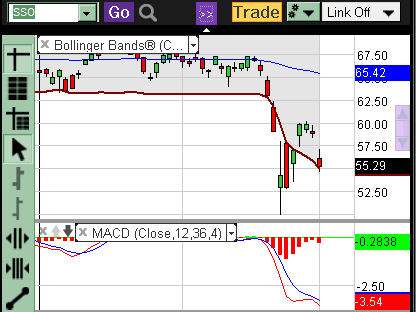

Of the three charts, we can see that XIV closed today below the Bollinger Band while SSO closed on the Bollinger Band and TNA closed above the lower band. The size of the sell histogram bar in each case tells the same story in the same order. TNA appears to be holding up the best and if the current trend continues, will break out first. XIV will be the last to turn with SSO most likely happening sometime between the two.

Since TNA is based on the Russell 2000 (small caps) and SSO based on the S&P 500 (large caps), it seems to indicate it will be the small caps, once again, that will lead the charge off the bottom when it occurs.